capital gains tax increase canada

Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. It was then increased to 6667 per cent in 1988 and then to a high of 75 per.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

The capital gains inclusion rate refers to how much of a capital gain is taxable.

. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on. He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. In 1990 the amount increased again to 75.

This determines how much of your capital gains youll have to pay tax on. If these rules apply to you you may be able to postpone paying tax on any capital gains you had from the transfer. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years.

In February 2000 the amount decreased back to 6667 and then in October 2000 the amount dropped to 50 which is where we are today. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. Under Canadian tax law only 50 per cent of capital gains are taxable at your marginal rate.

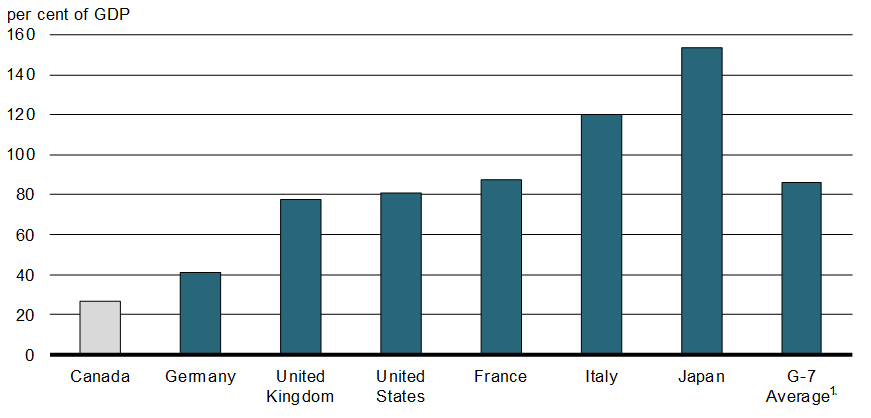

And as it turns out high-income earners pay the majority of capital gains tax. And the tax rate depends on your income. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing.

A capital gains tax increase would be a form of annual wealth tax that would be very simple. 4 The effective marginal tax rate of 195 per cent incorporates the inclusion rate of 75 per cent on realized capital gains income that was in place from 1990 until 1999. Some of the more common transfers are noted below.

With Ottawas huge deficit due to the pandemic there is no better time to increase the capital gains tax inclusion rate to 75 writes Amir Barnea. Different types of realized capital gains are taxed by the CRA including securities some forms of real estate and other personal property that tends to increase in value over time. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues.

But another thing to consider is the inclusion rate. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. In Canada the capital gains inclusion rate is 50.

Currently its 50 in Canada but has been as high as 75 historically. If this were to happen the benefit of earning capital gains instead of income would be reduced. Of the total 546 percent was declared by taxpayers with incomes over 250000.

Adjusting for inflation 40000 in taxable income in 1994 is equivalent to 63685 in 2020. So this means youll pay tax on half of your capital gains. Capital Gains 2021.

Capital Gains Tax Rate. Tax on capital gain 5353 b 10706 16059 0 0 Tax savings from 5041 donation tax credit c 25205 25205 25205 25205 Total cost of donation a b c 35501 40854 24795 24795. When the tax was first introduced to Canada the inclusion rate was 50.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000. Only half of your capital gains are included in your taxable income in the year in which the asset is sold.

You cannot use an RFL to create or increase a capital loss from selling farmland. Multiply 5000 by the tax rate listed according to your annual income minus any. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

There has been some desire from federal parties to increase the capital gains inclusion rate to 75 or higher. In all Canadians realized 729 billion in taxable capital gains. By Amir Barnea Contributing Columnist Sat.

In Canada 50 of the value of any capital gains are taxable. Depending on your province of residence for high-income earners the marginal tax rate on capital gains in 2020 can be as high as 27 per cent.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Taxtips Ca Business 2020 Corporate Income Tax Rates

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Taxes And Your Investments

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly